Purchase-to-let property is a wealth machine that many in Singapore or Asia suppose is good for his or her retirement earnings. (In case you might be new to the idea of wealth machines, you possibly can learn it right here)

I’m okay with that as a wealth machine.

It’s simply that how do you intend your monetary independence, or retirement with the earnings from a buy-to-let property?

There are two questions we have to take care of:

- What’s the beginning earnings that you just use to plan?

- How does the earnings develop from the beginning and over time?

Answering these two questions have important end result as to whether your plan work or not.

The quite common assumptions utilized in planning:

- The present rental yield that the shopper or prospect has secured.

- An assume annual development charge of 2-3% p.a.

Are these planning assumptions sound? I don’t know.

If we have a look at the info, planning like this will likely end in a mismatch in your expectations evaluate to the fact.

I understand that we now have about 15.5 years of gross HDB rental earnings information that may assist us perceive the precise earnings development. With this information we are able to see:

- Think about somebody occurs to not be dwelling in one of many HDB flats.

- Absolutely paid off the flat.

- Is paid an earnings that the home-owner must assist her or him?

- If the home-owner think about that they return to yr X, and lives by this earnings expertise, how a lot anxiousness will they really feel? Or would they’ve peace of thoughts?

HDB has some historic median gross rental earnings information of varied Singapore areas right here.

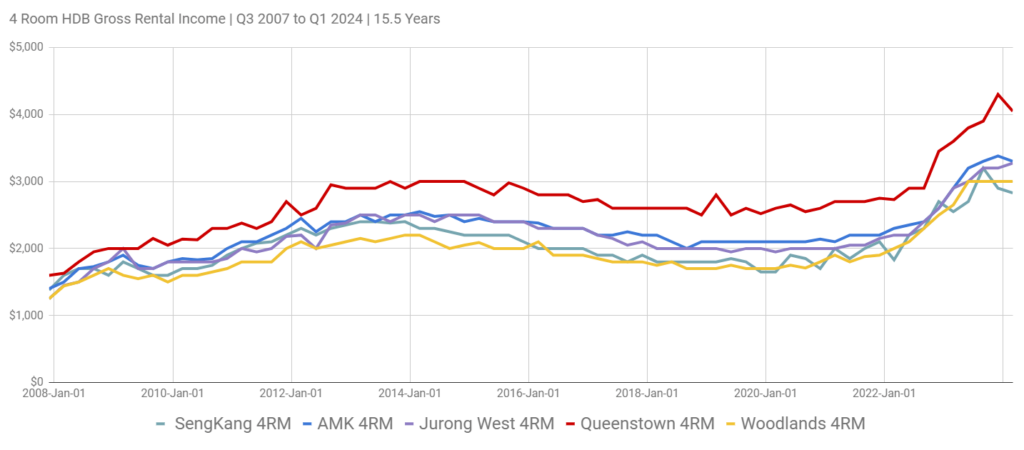

I tabulated the gross rental earnings for 5 Singapore areas (Sengkang, Ang Mo Kio, Jurong West, Queenstown and Woodlands) from Q3 2007 to Q1 2024 beneath:

Now I do know, most of us contemplate our HDB flat as our live-in residential and are usually not renting it out. Nevertheless, since we now have quite a few HDB flats, fairly a good bit of demand and provide, this permits us to mirror on the character of earnings change and if our wants could be met.

I’ve accomplished it with chosen non-public condominium rental information. The set is lesser however the nature of earnings change just isn’t too totally different.

I chosen Sengkang as a result of I used to be fascinated by it, after which choose Queenstown as a result of by proper, it’s close to city and we might even see a special worth pattern. I chosen Woodlands as a result of the hire is the bottom.

Though I current solely 4-room HDB, the rental earnings pattern for 3 and 5-room just isn’t too totally different.

We observe that Queenstown and Woodlands most frequently are the very best and lowest respectively. The earnings of all 5 areas go up and down in relative lock-steps.

These are the principle pattern:

- Rental earnings doesn’t go up from the underside left to high proper in a straight line.

- There is no such thing as a space that’s particular that goes in opposition to the pattern.

- From 2007 to 2013 (7 years), rental earnings appreciated.

- From 2013 to Sep 2020 (7 years), rental earnings went down.

- Sep 2022, rental earnings actually shot up.

If we expect from an individual that requires earnings, your expertise will probably be quite totally different:

- The retiree in 2007 noticed his or her earnings go up after which down and in Sep 2020 or 13.5 years later, his or her earnings is simply increased than the place they began off, earlier than seeing the earnings triple.

- The retiree in 2013 will see the earnings drop by 30% in Sep 2020 earlier than the earnings get well and went increased in 2024.

- The retiree in 2020 will see their earnings nearly up 80% in 2024.

What we should always mirror about is:

- There are occasions when the price of your spending line gadgets go up with inflation, however based mostly on rental earnings and provide, your earnings is perhaps happening as an alternative. In that case, what would you do?

- But for some, they may have massive earnings surpluses attributable to favorable demand and provide.

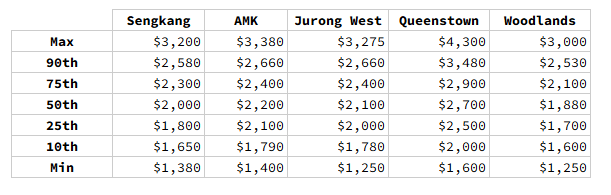

Here’s a desk exhibiting the vary of earnings:

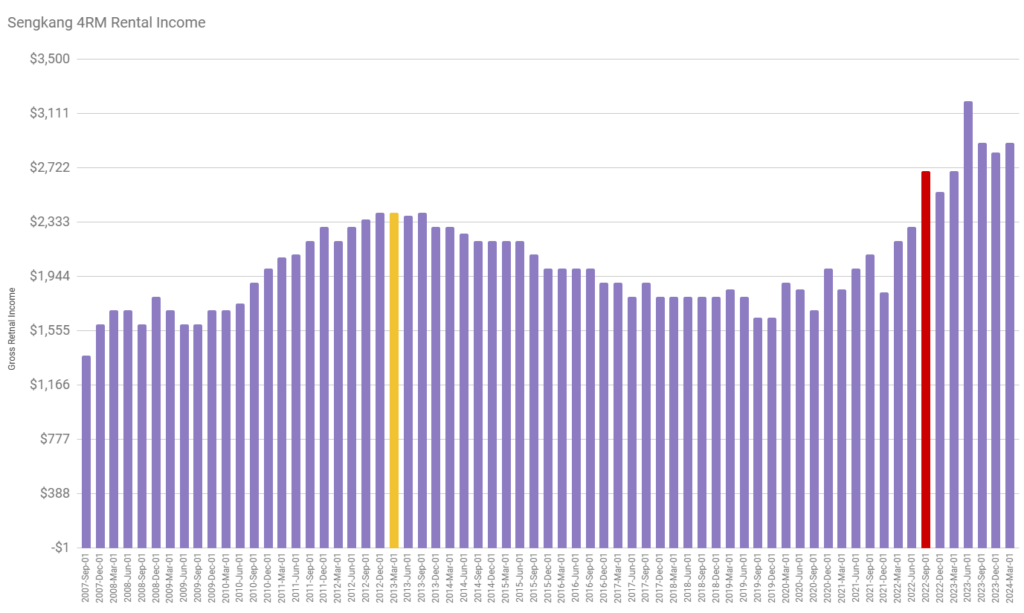

Here’s a abstract of the rental earnings development over this era:

- Sengkang: 4.6% p.a.

- Ang Mo Kio: 5.4% p.a.

- Jurong West: 5.9% p.a.

- Queenstown: 6.0% p.a.

- Woodlands: 5.5% p.a.

In case you plan utilizing this common rental earnings development, your precise earnings expertise could… not precisely match what you see.

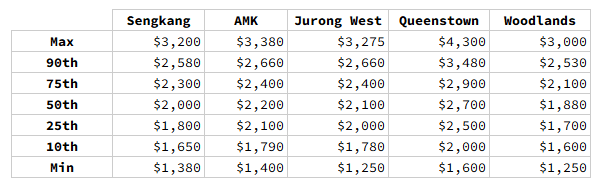

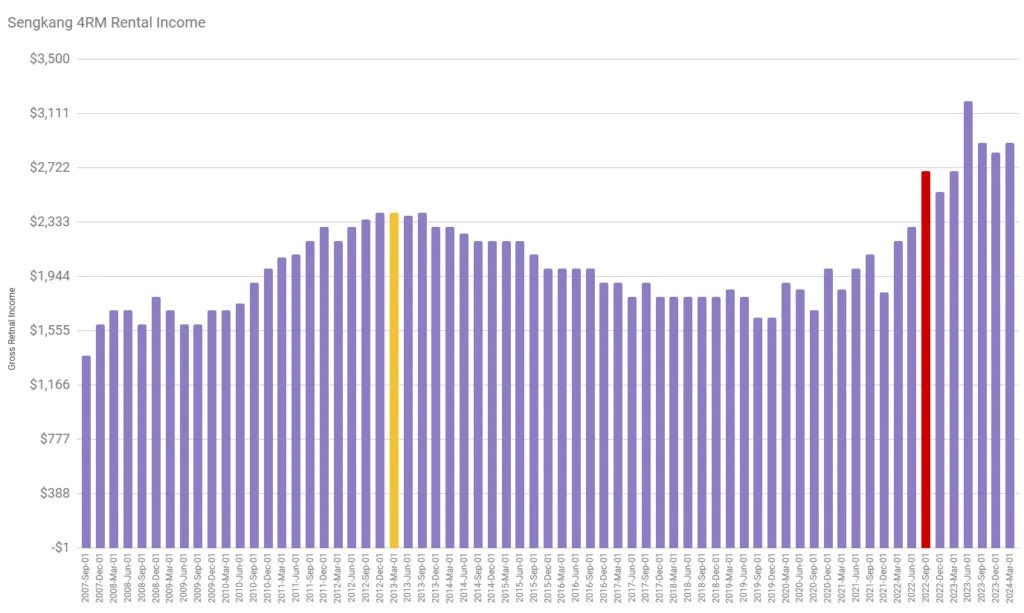

I separated out the rental earnings for Sengkang on it’s personal in your appreciation:

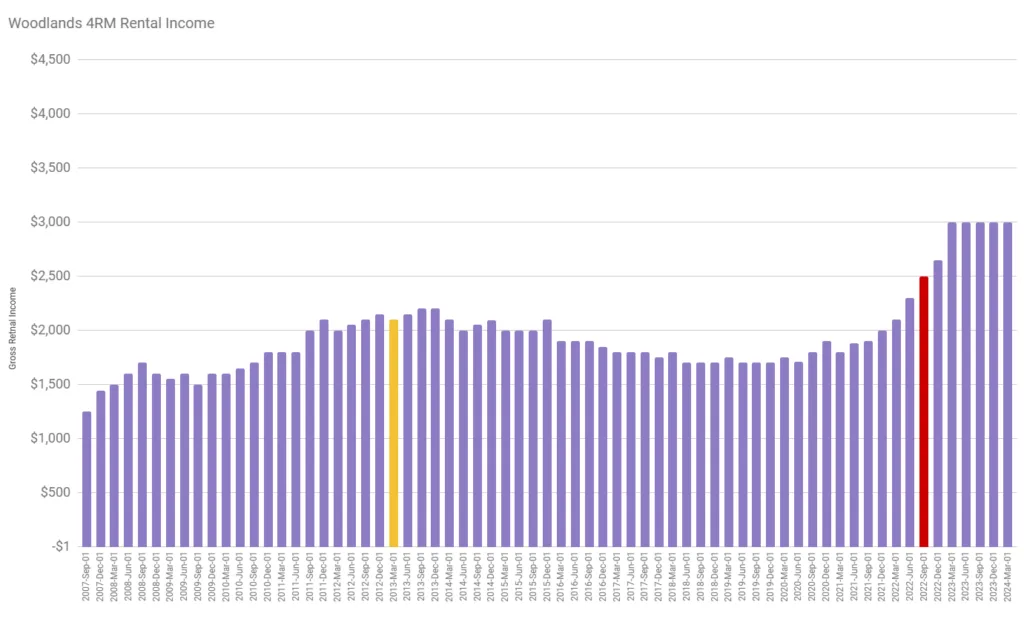

The yellow bar reveals the rental peak in Mar 2013 and the crimson bar reveals the best spike in Sep 2022.

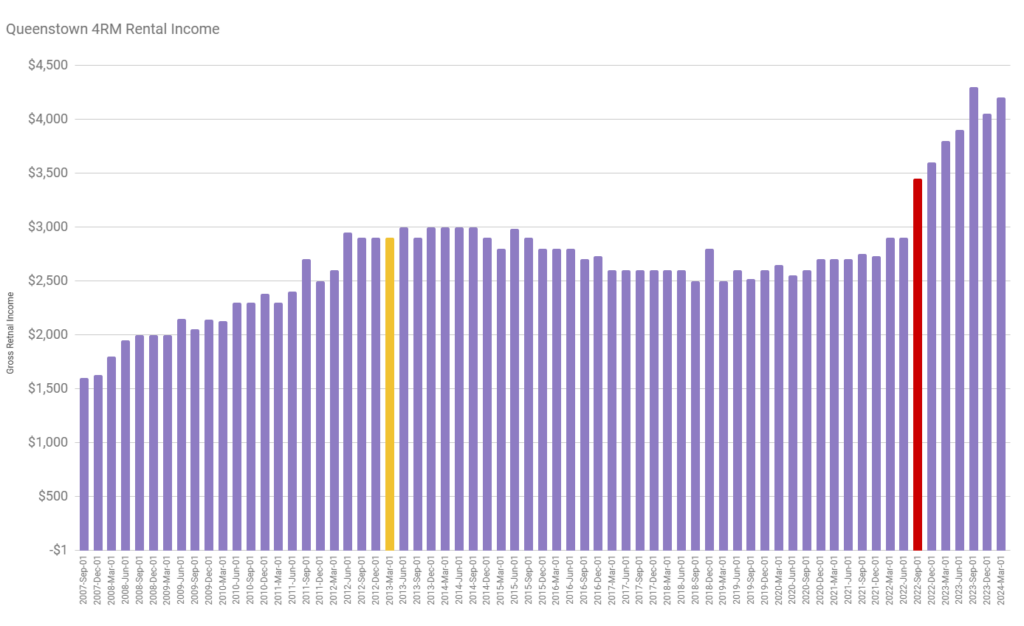

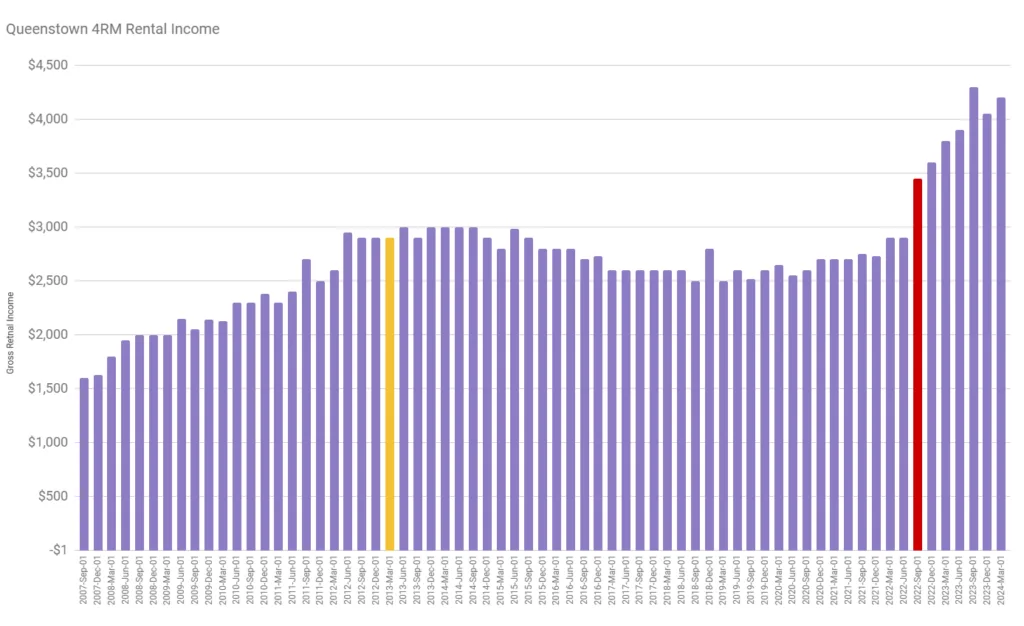

Right here is Queenstown:

We observe that for the reason that peak in 2013, the rental earnings present a smaller fall evaluate to Sengkang, Jurong West and Ang Mo Kio.

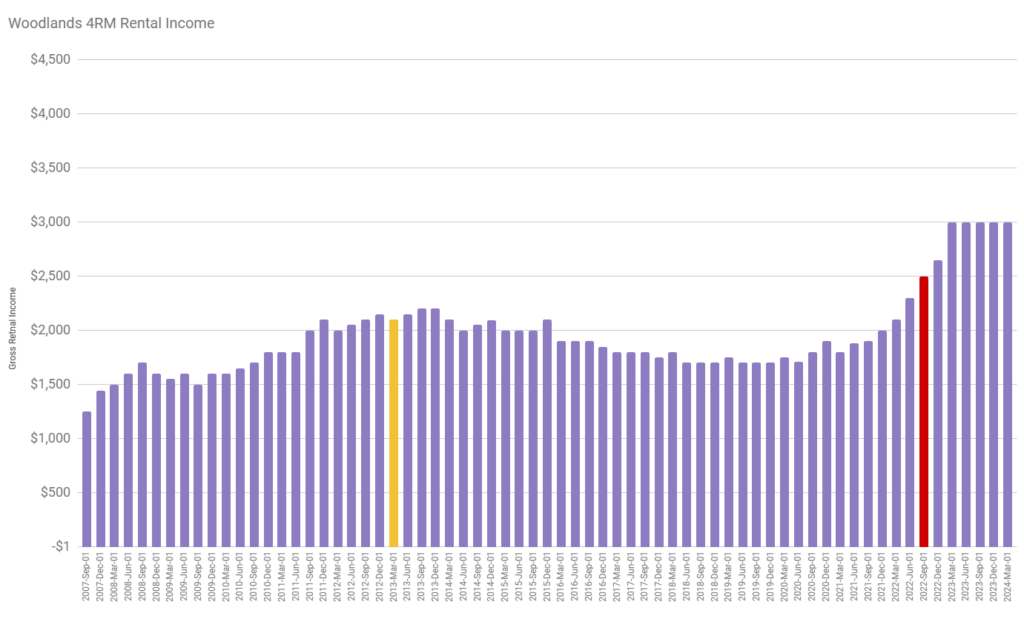

And right here is Woodlands:

Woodlands have the bottom gross rental earnings however unusually the median gross rental earnings lately is probably the most steady.

Conclusion

Now that you’ve got seen this information does it change how you’ll reply these two questions:

- What’s the beginning earnings that you just use to plan?

- How does the earnings develop from the beginning and over time?

If you’re retiring at present, and relying on the rental earnings, what could be the earnings that you just use in your planning?

At present, the earnings is $3,300 month-to-month. You’ll almost certainly have to incorporate the bills incur since you are renting it out to be lifelike however allow us to simply think about price just isn’t a difficulty.

Has the demand and provide of properties change a lot in 2022 that it’s totally different from the previous?

If sure, then as extra provide comes on-line, would rental earnings average like 2013 to 2020?

If no, then there isn’t any subject planning with $3,300 month-to-month.

The extra prudent folks could understand that they want a buffer between their spending wants and the earnings as a result of earnings volatility.

However how a lot?

The previous information may present you some hints. The earnings volatility could be as a lot as plus/minus 30%.

So if the online rental earnings is 9.5 months of $3,300 ($31,350), I might visualize {that a} conservative earnings is $31,350 x 70% = $21,945 ($1,828 month-to-month).

This earnings appears to be like low, till you see how potential the earnings is in these charts.

I invested in a diversified portfolio of exchange-traded funds (ETF) and shares listed within the US, Hong Kong and London.

My most well-liked dealer to commerce and custodize my investments is Interactive Brokers. Interactive Brokers assist you to commerce within the US, UK, Europe, Singapore, Hong Kong and lots of different markets. Choices as effectively. There aren’t any minimal month-to-month costs, very low foreign exchange charges for foreign money change, very low commissions for varied markets.

To search out out extra go to Interactive Brokers at present.

Be part of the Funding Moats Telegram channel right here. I’ll share the supplies, analysis, funding information, offers that I come throughout that allow me to run Funding Moats.

Do Like Me on Fb. I share some tidbits that aren’t on the weblog put up there usually. You too can select to subscribe to my content material through the e-mail beneath.

I break down my assets in keeping with these matters:

- Constructing Your Wealth Basis – If and apply these easy monetary ideas, your long run wealth needs to be fairly effectively managed. Discover out what they’re

- Energetic Investing – For energetic inventory traders. My deeper ideas from my inventory investing expertise

- Studying about REITs – My Free “Course” on REIT Investing for Newbies and Seasoned Buyers

- Dividend Inventory Tracker – Monitor all of the widespread 4-10% yielding dividend shares in SG

- Free Inventory Portfolio Monitoring Google Sheets that many love

- Retirement Planning, Monetary Independence and Spending down cash – My deep dive into how a lot you have to obtain these, and the alternative ways you could be financially free

- Providend – The place I used to work doing analysis. Payment-Solely Advisory. No Commissions. Monetary Independence Advisers and Retirement Specialists. No cost for the primary assembly to know the way it works

- Havend – The place I at the moment work. We want to ship commission-based insurance coverage recommendation in a greater means.