July 26, 2024 (Investorideas.com Newswire) Graphite One (TSXV:GPH; OTCQX:GPHOF) has taken one other step ahead in its plan to develop into the primary vertically built-in home graphite producer to serve the US electrical automobile battery market.

On Thursday, July 25, G1 introduced it has entered right into a non-binding Provide Settlement with Lucid Group, Inc. (NASDAQ: LCID), a California-based electrical automobile producer, for anode energetic supplies (AAM) utilized in EV batteries.

GPH shares rose 33% to $0.95/sh on the information.

Supply: Yahoo Finance

“This can be a historic second for Graphite One, Lucid and North America: the primary artificial graphite Provide Settlement between a U.S. graphite developer and U.S. EV firm,” mentioned Anthony Huston, Graphite One’s President and CEO.

“G1 is happy to proceed pushing ahead growing our 100% U.S. home provide chain. We respect the help from our traders and the grant from the Division of Protection. Topic to challenge financing required to construct the AAM facility, the Provide Settlement with Lucid places G1 on the trail to supply income in 2027,and that is only the start for Graphite One as work to fulfill market calls for and create a safe 100% U.S.-based provide chain for pure and artificial graphite for U.S. business and nationwide safety.”

Peter Rawlinson, CEO and CTO at Lucid, mentioned “We’re dedicated to accelerating the transition to sustainable autos and the event of a sturdy home provide chain ensures america, and Lucid will keep know-how management on this international race.

“Via work with companions like Graphite One, we can have entry to American-sourced crucial uncooked supplies, serving to energy our award-winning autos made with pleasure in Arizona.”

Lucid’s flagship automobile is the Lucid Air, which has been acknowledged with quite a few awards, together with MotorTrend 2022 Automotive of the 12 months, World Luxurious Automotive of the 12 months, and Automotive and Driver 10 Finest. Lucid is making ready a manufacturing unit in Arizona to start manufacturing of the Lucid Gravity SUV.

Provide Settlement

The Provide Settlement follows Graphite One’s choice in March 2024 of a website for the corporate’s proposed AAM facility in Warren, Ohio.

Via its wholly-owned subsidiary, Graphite One Alaska, the Vancouver-based firm selected Ohio’s Voltage Valley, getting into right into a 50-year land-lease settlement on 85 acres. The deal additionally comprises an choice to buy the property as soon as often known as the Warren Depot, a part of the Nationwide Protection Stockpile infrastructure, till the brownfield website was processed via the Ohio EPA Voluntary Motion program a decade in the past, certifying that the land doesn’t want additional cleanup.

Building is slated to start out throughout the subsequent three years. In response to Graphite One, the Voltage Valley website is within the coronary heart of the car business, with ample low-cost electrical energy produced from renewable vitality sources. It’s accessible by highway and rail, with close by barging services. Present energy traces are enough for Graphite One’s Part 1 manufacturing goal of 25,000 tonnes per yr of battery-ready anode materials. Land is on the market for follow-on phases to ramp as much as 100,000 tpy of manufacturing.

The five-year, non-binding Provide Settlement supplies for five,000 tpa of artificial graphite. Gross sales are primarily based on an agreed worth components linked to future market pricing, in addition to satisfying base-case pricing agreeable to each events.

Constructing a provide chain

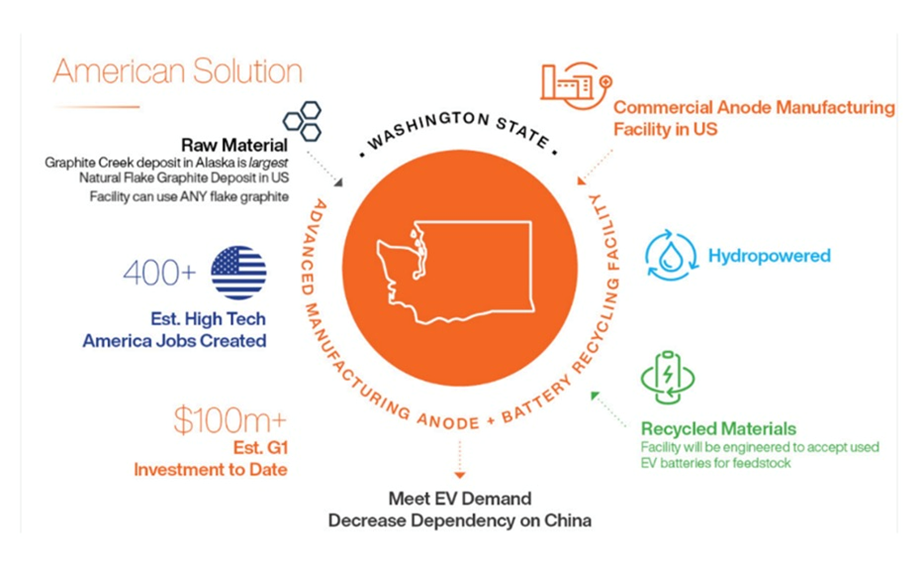

The Ohio facility represents the second hyperlink in Graphite One’s graphite supplies provide chain; the primary hyperlink is Graphite One’s Graphite Creek mine in Alaska, at present working towards completion of its Feasibility Examine in This autumn 2024, on an accelerated timetable, funded by a $37.5 million Protection Manufacturing Act grant from the Division of Protection in July 2023.

Topic to financing, the plant will manufacture artificial graphite till a pure graphite anode energetic supplies turns into obtainable from the corporate’s Graphite Creek mine, situated close to Nome, Alaska, in keeping with the March twentieth information launch.

The plan additionally features a recycling facility to reclaim graphite and different battery supplies, to be co-located on the Ohio website, which is the third hyperlink in Graphite One’s round financial system technique.

Among the many introduced tasks coming to Ohio, South Korean-based LG Vitality Resolution has partnered with Basic Motors in Ultium Cells LLC, which is constructing a $2.3 billion electric-vehicle manufacturing plant in Lordstown, Ohio; Honda and LG Vitality Resolution will assemble a brand new EV battery plant in Fayette County; and Honda additionally introduced $700 million to retool three of its present factories in Union, Logan, and Shelby counties for EV manufacturing.

Artificial vs pure graphite

Artificial, or synthetic graphite, and pure graphite are each utilized in battery anode functions, however artificial dominates the market.

China is the primary graphite producer on the planet, outputting 850,000 tonnes in 2022, and accounting for two-thirds of mine provide. Furthermore, the Asian nation additionally controls 80% of artificial graphite manufacturing.

Artificial graphite’s major software is within the graphite electrodes used for electrical arc furnace steelmaking, which accounts for 70-80% of graphite electrode consumption. The marketplace for this sector is estimated at 1.6 million tons in 2024, and is predicted to reached 1.9Mt by 2029, in keeping with Mordor Intelligence.

The enhance is partly as a result of Chinese language authorities’s current Work Plan for Regular Progress of the Iron and Metal Business, which promotes the growth of metal manufacturing with electrical arc furnaces.

Whole artificial graphite consumption is pegged at 3.04Mt this yr, in comparison with 1.68Mt for pure graphite.

Authorities/ neighborhood help

Graphite One has acquired robust help from the US authorities for growing its “made in America” graphite provide chain anchored by Graphite Creek, the biggest graphite deposit within the nation and amongst the biggest on the planet. Two Division of Protection grants have already been awarded, one for $37.5 million, the opposite for $4.7 million.

G1’s feasibility examine is now 75% funded by the DoD.

As well as, G1 qualifies for federal mortgage ensures from the $72 billion federal mortgage fund to help revolutionary vitality and provide chain initiatives.

Graphite One’s significance to the US authorities is exemplified via CEO Anthony Huston’s look at a current White Home occasion.

China, in the meantime, has imposed restrictions on Chinese language graphite exports. Exporters should apply for permits to ship artificial and pure flake graphite.

Graphite One is on the forefront of this development. The corporate has vital monetary backing from the Division of Protection, and political help from the best ranges of presidency, together with the White Home, Alaska senators, Alaska’s governor, and the Bering Straits Native Company, which has already made a $2 million funding with an choice to take a position an extra $8.4 million.

The Graphite Creek mine is not close to a salmon fishery and it has the backing of native communities, together with as the town of Nome with its US$600 million port growth. Nome has a protracted historical past of useful resource extraction.

Lowering US dependence

Graphite One may take a number one function in loosening China’s tight grip on the US graphite market by mining feedstock from its Graphite Creek challenge in Alaska and delivery it to its deliberate graphite anode manufacturing plant in Voltage Valley, Ohio. Initially, G1 will produce artificial graphite and different graphite merchandise from bought graphite.

Graphite One may provide a good portion of the graphite demanded by america.

Take into account: In 2023, the US imported 83,000 tonnes of pure graphite, of which 89% was flake and high-purity, appropriate for electrical autos. Primarily based on G1’s Prefeasibility Examine (PFS), not the Feasibility Examine which is predicted this fall, the Graphite Creek mine is anticipated to supply, on common, 51,813 tonnes of graphite focus per yr throughout its projected 23-year mine life.

Conclusion

The one technique to alleviate import dependence is for america to seek out its personal supply of graphite manufacturing, and at AOTH we consider a challenge like Graphite One’s Graphite Creek deposit ticks all of the bins.

Graphite is included on a record of 23 crucial metals the US Geological Survey has deemed crucial to the financial system and nationwide safety.

China is by far the most important graphite producer at about 80% of worldwide manufacturing. It additionally controls nearly all graphite processing, establishing itself as a dominant participant in each stage of the provision chain. The US at present produces no graphite, and due to this fact should rely solely on imports to fulfill home demand.

Washington has lastly begun to acknowledge this vulnerability. In 2022, President Biden issued a Presidential Willpower beneath the 1950 Protection Manufacturing Act (DPA), declaring graphite and 4 different key battery minerals liable to provide disruptions, as “important to the nationwide protection.”

Graphite is the biggest ingredient in lithium-ion batteries by weight, making it a highly-sought-after uncooked materials by battery-makers.

The U.S. Vitality Division forecasts that international graphite demand may very well be greater than eight instances present manufacturing by 2035.

The PFS was primarily based on the exploration of just one sq. kilometer of the 16-km deposit, that means that G1 may doubtlessly enhance manufacturing by an element a number of instances the proposed run price of two,860 tonnes per day.

Solely about 10% of the mineralized development has been drilled to date.

“The continued growth of our Graphite Creek useful resource will help our plan to quadruple the annual manufacturing from our PFS examine,” mentioned Graphite One Senior Vice President of Mining Mike Schaffner.

Final yr, accomplished a 52 gap, 8,736-meter drill program centered on upgrading and increasing the deposit, and amassing information for the Feasibility Examine. The corporate mentioned the outcomes demonstrated distinctive consistency of a shallow, high-grade graphite deposit that continues to be open each to the east and west of the prevailing mineral useful resource estimate.

Graphite One’s 2024 discipline program will collect the remaining information required to finish the Feasibility Examine. The corporate says three drill rigs are at present working to glean geotechnical data wanted to engineer the pit partitions and foundations for the method facility, tailings/waste rock facility and different infrastructure.

Twenty-two summer time job positions have been stuffed by native residents from the communities of Teller, Brevig Mission and Nome.

Graphite One – Two-Pronged Manufacturing Localizing Graphite Provide

A current report by Atrium Analysis highlights 5 attributes of Graphite One which help an funding within the firm:

- Sizeable graphite growth challenge with giant upside;

- Tailwinds for the superior anode manufacturing facility;

- Two-pronged method reduces dangers;

- Robust authorities and neighborhood help; and

- Vital low cost to friends.

Upcoming catalysts embody a Useful resource Replace and Feasibility Examine in This autumn, and ongoing authorities grants, partnerships and investments.

Graphite One Inc.

TSXV:GPH, OTCQX:GPHOF

2024.07.25 share worth: Cdn$0.95

Shares Excellent: 137.8m

Market cap: Cdn$130.9m

GPH web site

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free e-newsletter

Authorized Discover / Disclaimer

Forward of the Herd e-newsletter, aheadoftheherd.com, hereafter often known as AOTH.

Please learn the complete Disclaimer fastidiously earlier than you utilize this web site or learn the e-newsletter. If you don’t comply with all of the AOTH/Richard Mills Disclaimer, don’t entry/learn this web site/e-newsletter/article, or any of its pages. By studying/utilizing this AOTH/Richard Mills web site/e-newsletter/article, and whether or not you really learn this Disclaimer, you might be deemed to have accepted it.

Any AOTH/Richard Mills doc is just not, and shouldn’t be, construed as a suggestion to promote or the solicitation of a suggestion to buy or subscribe for any funding.

AOTH/Richard Mills has primarily based this doc on data obtained from sources he believes to be dependable, however which has not been independently verified.

AOTH/Richard Mills makes no assure, illustration or guarantee and accepts no duty or legal responsibility as to its accuracy or completeness.

Expressions of opinion are these of AOTH/Richard Mills solely and are topic to vary with out discover.

AOTH/Richard Mills assumes no guarantee, legal responsibility or assure for the present relevance, correctness or completeness of any data supplied inside this Report and won’t be held responsible for the consequence of reliance upon any opinion or assertion contained herein or any omission.

Moreover, AOTH/Richard Mills assumes no legal responsibility for any direct or oblique loss or injury for misplaced revenue, which you will incur on account of the use and existence of the knowledge supplied inside this AOTH/Richard Mills Report.

You agree that by studying AOTH/Richard Mills articles, you might be performing at your OWN RISK. In no occasion ought to AOTH/Richard Mills responsible for any direct or oblique buying and selling losses brought on by any data contained in AOTH/Richard Mills articles. Data in AOTH/Richard Mills articles is just not a suggestion to promote or a solicitation of a suggestion to purchase any safety. AOTH/Richard Mills is just not suggesting the transacting of any monetary devices.

Our publications aren’t a advice to purchase or promote a safety – no data posted on this website is to be thought of funding recommendation or a advice to do something involving finance or cash other than performing your individual due diligence and consulting along with your private registered dealer/monetary advisor. AOTH/Richard Mills recommends that earlier than investing in any securities, you seek the advice of with an expert monetary planner or advisor, and that you need to conduct a whole and unbiased investigation earlier than investing in any safety after prudent consideration of all pertinent dangers. Forward of the Herd is just not a registered dealer, vendor, analyst, or advisor. We maintain no funding licenses and will not promote, provide to promote, or provide to purchase any safety.

Extra Data:

Disclaimer/Disclosure: Investorideas.com is a digital writer of third social gathering sourced information, articles and fairness analysis in addition to creates authentic content material, together with video, interviews and articles. Unique content material created by investorideas is protected by copyright legal guidelines aside from syndication rights. Our website doesn’t make suggestions for purchases or sale of shares, companies or merchandise. Nothing on our websites must be construed as a suggestion or solicitation to purchase or promote merchandise or securities. All investing includes danger and potential losses. This website is at present compensated for information publication and distribution, social media and advertising, content material creation and extra. Disclosure is posted for every compensated information launch, content material printed /created if required however in any other case the information was not compensated for and was printed for the only curiosity of our readers and followers. Contact administration and IR of every firm immediately concerning particular questions.

Extra disclaimer information: https://www.investorideas.com/About/Disclaimer.asp Study extra about publishing your information launch and our different information companies on the Investorideas.com newswire https://www.investorideas.com/Information-Add/

World traders should adhere to rules of every nation. Please learn Investorideas.com privateness coverage: https://www.investorideas.com/About/Private_Policy.asp