- Preliminary discovery to graduation of a Preliminary Financial Evaluation(” PEA“) in underneath two years

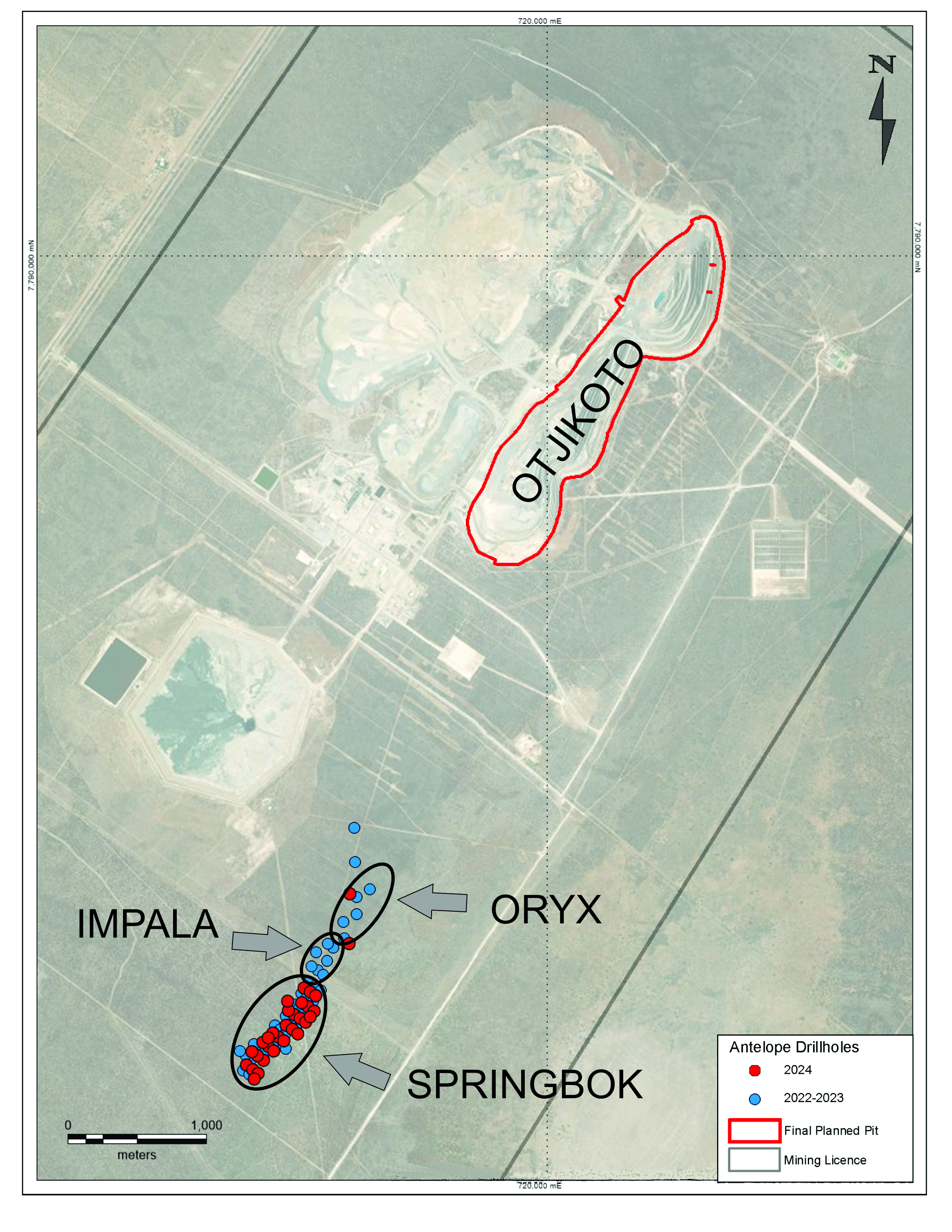

- The Antelope deposit, comprised of the Springbok Zone, the Oryx Zone, and a attainable third construction, Impala, topic to confirmatory drilling, was found in 2022 following deep drill testing by B2Gold exploration personnel on three-dimensional fashions of airborne magnetic knowledge

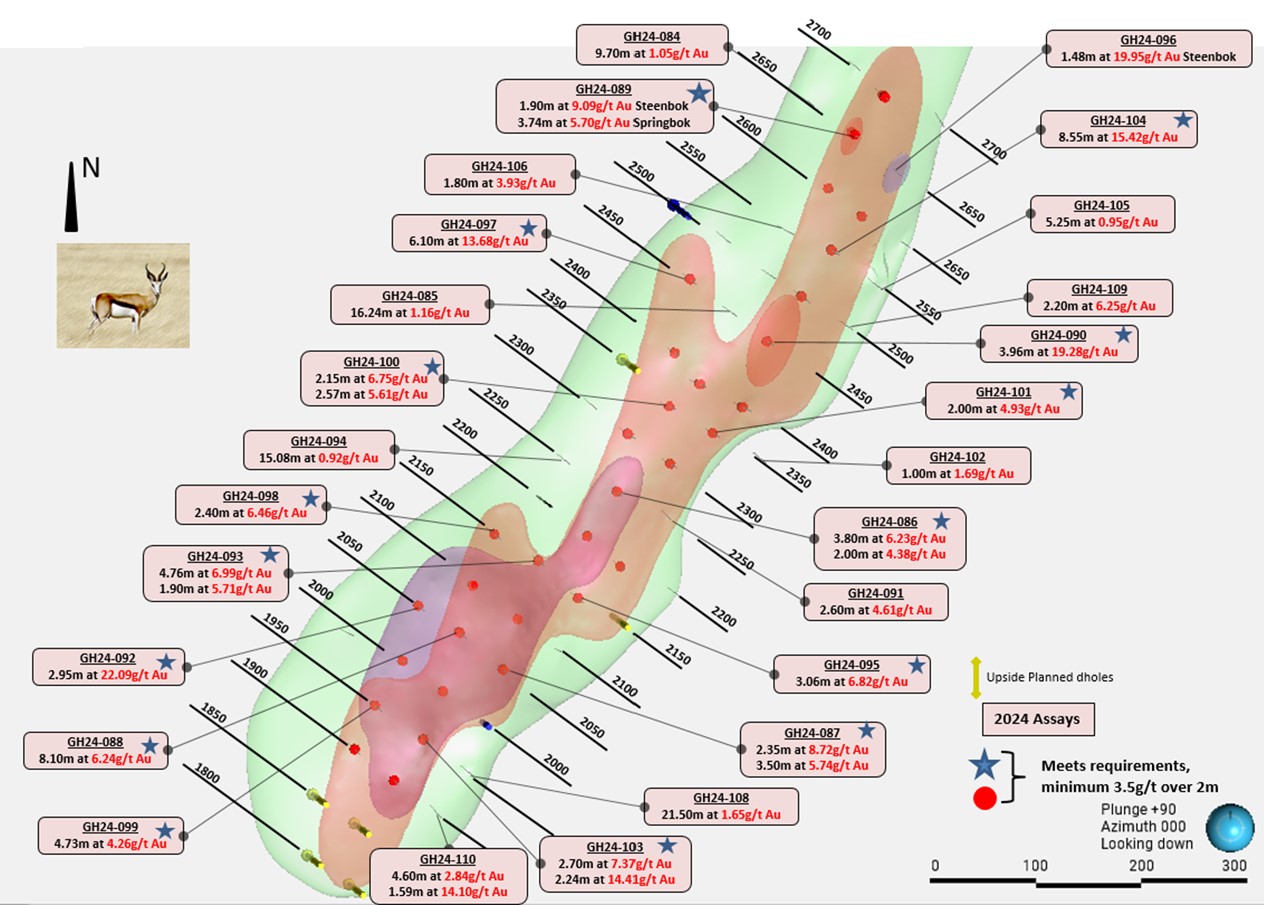

- Over 36,000 meters (“m”) have been drilled into the Springbok Zone up to now, with 33 holes totaling 16,950 m accomplished in 2024, to determine the 50 x 50 m spacing that informs this preliminary Inferred Mineral Useful resource Estimate

- Preliminary Inferred Mineral Useful resource Estimate of 390,000 gold ounces meets the B2Gold threshold to provoke PEA-level research of growth by underground mining strategies, just like the Wolfshag deposit

- The Mineral Useful resource estimate on the Springbok Zone that may type the idea for a possible PEA consists of Inferred Mineral Sources of 1.75 million tonnes grading 6.91 grams per tonne (“g/t”) gold for a complete of 390,000 ounces of gold

- Ongoing exploration drilling on the Oryx Zone, which seems to characterize a second shoot northeast of and stacked stratigraphically above the Springbok Zone, has returned high-grade intervals that exhibit the potential to extend the Mineral Useful resource estimate

- Topic to receipt of a constructive PEA research and allow, mining of the Springbok Zone, coupled with the exploration potential of the better Antelope deposit, might start to contribute to gold manufacturing at Otjikoto in 2026

- Potential to complement the processing of low-grade stockpiles on the Otjikoto Mine by means of 2031, with the aim of accelerating gold manufacturing ranges to over 100,000 ounces per 12 months from 2026 by means of 2031

- Latest drilling on the Springbok Zone stays open southward, indicating extra exploration potential past the at the moment outlined useful resource

- Drill gap GH24-097 intersected 13.68 g/t gold over 6.10 m from 470.63 m, and drill gap GH24-104 intersected 21.64 g/t gold over 5.88 m from 502.37 m

Determine 1. Otjikoto Mine and Antelope Deposit Location Overview

Springbok Zone June 2024 Mineral Useful resource Estimate

| Class | Area | Tonnes | Gold Grade (g/t Au) |

Contained Gold Ounces |

| Inferred | Springbok | 1,630,000 | 7.09 | 370,000 |

| Inferred | Different | 130,000 | 4.60 | 20,000 |

| Inferred | Whole | 1,750,000 | 6.91 | 390,000 |

Notes:

- The Certified Particular person as outlined underneath Nationwide Instrument 43-101 for the Springbok Zone June 2024 Mineral Useful resource estimate is Andrew Brown, P.Geo., B2Gold’s Vice President, Exploration.

- Mineral Sources have been labeled utilizing the 2014 CIM Definition Requirements. Mineral Sources that aren’t Mineral Reserves wouldn’t have demonstrated financial viability. There is no such thing as a assure that every one or any a part of the Mineral Useful resource will likely be transformed right into a Mineral Reserve. Inferred Sources are thought-about too geologically speculative to have mining and financial concerns utilized to them that will allow them to be categorized as Mineral Reserves.

- The Springbok Zone June 2024 Mineral Useful resource Estimate has an efficient date of June 14, 2024.

- Mineral Sources are reported on a 100% foundation.

- The Springbok Zone June 2024 Mineral Useful resource Estimate assumes an underground mining technique. Mineral assets are reported inside optimized stopes that have been created utilizing a 3 g/t Au cut-off and minimal thickness of 4 m.

- “Different” useful resource ounces are adjoining to the principle Springbok Zone and are inside the 50 x 50 m drill spacing that defines the inferred mineral useful resource.

- All tonnage, grade and contained metallic content material estimates have been rounded; rounding might lead to obvious summation variations between tonnes, grade, and contained metallic content material.

Useful resource Mannequin Methodology

The preliminary Springbok Mineral Useful resource mannequin was ready in-house by B2Gold personnel. Drilling accomplished in assist of the June 2024 Mineral Useful resource Estimate consists of 60 diamond drillholes (32,249 m of drilling).

Excessive-grade mineralization on the Springbok Zone kinds shallowly plunging shoots inside gently dipping stratigraphy. Excessive-grade and low-grade mineralization domains have been modeled alongside these traits in three-dimensions and used to manage the estimation of gold grades.

All assets on the Springbok Zone are hosted inside recent rock.

Outlier assays have been capped at 4 g/t gold within the low-grade area and 35 g/t gold within the high-grade area. Gold grades have been capped previous to compositing to 1 m. Grades have been estimated into the block mannequin utilizing Inverse Distance Cubed (ID3) interpolation with searches dynamically managed alongside mineralized zone traits.

A complete of 4,382 bulk density measurements have been made at web site on drill core samples utilizing the Archimedes water-displacement technique. The common density is 3.11 tonnes per cubic meter (“t/m 3 “) within the low-grade area and three.37 t/m 3 within the high-grade area.

Nominal drill gap spacing for Inferred Mineral Sources is 50 x 50 m.

2024 Otjikoto Exploration Drilling Program

The 2024 exploration finances for Namibia is $9 million, funding the most important drill program on the Otjikoto Mine because the definition of the Wolfshag discovery in 2012. A complete of 39,000 m of drilling have been budgeted for 2024 and 5 rigs are at the moment energetic on the drill program.

General, the Antelope deposit mineralization has been intersected by drilling over a mixed strike size of roughly 1,500 m. Over two km of potential stratigraphy stay comparatively untested between the Oryx Zone and the southernmost recognized mineralization in Section 5 of the Otjikoto Mine open pit. Drilling over this zone is deliberate for the second half of 2024.

The preliminary Inferred Mineral Useful resource for the Springbok Zone is a major milestone, following the 2022 discovery of the Antelope deposit, a blind goal, in that mineralization doesn’t outcrop on the Otjikoto mining license. Mineralization within the Springbok Zone is characterised by quartz-pyrrhotite-magnetite veins and regionally, seen gold. Mineralization has been overprinted by deformation centered alongside two major marble beds, that function main stratigraphic markers within the Otjikoto Mine stratigraphy.

Excessive-grade gold mineralization reveals continuity alongside a shoot-like geometry plunging shallowly north-northeast. This means a delicate inflection within the stratigraphy that hosts the Otjikoto deposit, the place the mineralized zones plunge shallowly south-southwest. Of the 16,950 m of drilling accomplished on the Springbok Zone in 2024, drill holes reminiscent of GH24-104 (21.64 g/t gold over 5.88 m from 502.37 m) and GH24-097 (13.68 g/t gold over 6.10 m from 470.63 m) spotlight a number of the high-grade width intervals current inside the Springbok Zone. One of the latest drill holes, GH24-117, intersected 7.13 g/t gold over 6.56 m from 416.72 m, together with a higher-grade interval of 11.13 g/t gold over 3.81 m, and is the southernmost intersection of the Springbok Zone, indicating that mineralization stays open-ended to the southeast. As beforehand reported, the deep mineralization within the Antelope deposit, together with the Springbok Zone, is doubtlessly amenable to underground mining primarily based on comparable inputs from the underground mining of the Wolfshag deposit.

Highlights from the 2024 infill drill program on the Springbok Zone embrace:

| HoleID | Zone | From (m) | To (m) | Size (m) | Au (g/t) |

| GH24-088 | Springbok | 438.60 | 446.70 | 8.10 | 6.24 |

| GH24-093 | Springbok | 445.14 | 449.90 | 4.76 | 6.99 |

| GH24-097 | Springbok | 470.63 | 476.73 | 6.10 | 13.68 |

| GH24-099 | Springbok | 432.80 | 437.53 | 4.73 | 4.26 |

| GH24-104 | Springbok | 502.37 | 508.25 | 5.88 | 21.64 |

| GH24-117 | Springbok | 416.72 | 423.28 | 6.56 | 7.13 |

Observe:

- All composites reported are above a 3.5 g/t gold cutoff, making use of a most inner dilution of two m. Outcomes are uncapped. Core lengths approximate true width of mineralized intervals.

With the 50 x 50 m infill drill program of the Springbok Zone accomplished, three rigs will likely be deployed to the Oryx Zone. Beforehand introduced drill holes reminiscent of GH23-056, which intersected 9.86 g/t gold over 7.48 m from 517.55 m, point out that useful resource potential is open to the northeast alongside strike from the Springbok Zone.

Determine 2. Springbok Zone 2024 Infill Drilling Outcomes

High quality Assurance/High quality Management on Pattern Assortment and Assaying

LeachWell evaluation on the Otjikoto Mine Lab has been the first technique of study of half core (NQ) samples from the Antelope deposit. Assay composites introduced herein are derived from 1-kilogram samples. Tails from mineralized zones are fireplace assayed to find out the gold recoveries, which averages ~95%. Quarterly submission of coarse reject materials is shipped to a licensed exterior laboratory for Display screen Fireplace Assay examine evaluation. In-house research by B2Gold point out that LeachWell outcomes examine favorably to fireplace assay accomplished by ALS Johannesburg.

High quality assurance and high quality management procedures embrace the systematic insertion of blanks, LeachWell licensed requirements and duplicates within the drill core pattern sequence. The outcomes of the management samples are evaluated frequently with partial batches re-analyzed and/or resubmitted on exploration samples, as wanted. All outcomes said on this announcement have been accepted based on B2Gold’s high quality assurance and high quality management protocols.

About B2Gold

B2Gold is a low-cost worldwide senior gold producer headquartered in Vancouver, Canada. Based in 2007, in the present day, B2Gold has working gold mines in Mali, Namibia and the Philippines, the Goose Challenge underneath building in northern Canada and quite a few growth and exploration tasks in varied nations together with Mali, Colombia and Finland.

Certified Individuals

Andrew Brown, P.Geo., Vice President, Exploration at B2Gold, a professional particular person underneath Nationwide Instrument 43-101, has reviewed and accredited the scientific data associated to exploration and mineral useful resource issues contained on this information launch.

ON BEHALF OF B2GOLD CORP.

” Clive T. Johnson ”

President & Chief Government Officer

The Toronto Inventory Alternate and NYSE American LLC neither approve nor disapprove the data contained on this information launch.

Manufacturing outcomes and manufacturing steering introduced on this information launch mirror whole manufacturing on the mines B2Gold operates on a 100% challenge foundation. Please see our Annual Info Type dated March 14, 2024, for a dialogue of our possession curiosity within the mines B2Gold operates.

This information launch consists of sure “forward-looking data” and “forward-looking statements” (collectively forward-looking statements”) inside the which means of relevant Canadian and United States securities laws, together with: projections; outlook; steering; forecasts; estimates; and different statements relating to future or estimated monetary and operational efficiency, gold manufacturing and gross sales, revenues and money flows, and capital prices (sustaining and non-sustaining) and working prices, together with projected money working prices and AISC, and budgets on a consolidated and mine by mine foundation; future or estimated mine life, metallic worth assumptions, ore grades or sources, gold restoration charges, stripping ratios, throughput, ore processing; statements relating to anticipated exploration, drilling, growth, building, allowing and different actions or achievements of B2Gold; and together with, with out limitation: the potential for the Antelope deposit to be developed as an underground mining operation and contribute gold in the course of the low-grade stockpile processing on the Otjikoto Mine in 2026. All statements on this information launch that tackle occasions or developments that we anticipate to happen sooner or later are forward-looking statements. Ahead-looking statements are statements that aren’t historic information and are usually, though not at all times, recognized by phrases reminiscent of “anticipate”, “plan”, “anticipate”, “challenge”, “goal”, “potential”, “schedule”, “forecast”, “finances”, “estimate”, “intend” or “consider” and related expressions or their adverse connotations, or that occasions or circumstances “will”, “would”, “might”, “might”, “ought to” or “may” happen. All such forward-looking statements are primarily based on the opinions and estimates of administration as of the date such statements are made.

Ahead-looking statements essentially contain assumptions, dangers and uncertainties, sure of that are past B2Gold’s management, together with dangers related to or associated to: the volatility of metallic costs and B2Gold’s frequent shares; modifications in tax legal guidelines; the risks inherent in exploration, growth and mining actions; the uncertainty of reserve and useful resource estimates; not attaining manufacturing, price or different estimates; precise manufacturing, growth plans and prices differing materially from the estimates in B2Gold’s feasibility and different research; the flexibility to acquire and preserve any obligatory permits, consents or authorizations required for mining actions; environmental laws or hazards and compliance with complicated laws related to mining actions; local weather change and local weather change laws; the flexibility to switch mineral reserves and establish acquisition alternatives; the unknown liabilities of corporations acquired by B2Gold; the flexibility to efficiently combine new acquisitions; fluctuations in trade charges; the supply of financing; financing and debt actions, together with potential restrictions imposed on B2Gold’s operations in consequence thereof and the flexibility to generate enough money flows; operations in international and growing nations and the compliance with international legal guidelines, together with these related to operations in Mali, Namibia, the Philippines and Colombia and together with dangers associated to modifications in international legal guidelines and altering insurance policies associated to mining and native possession necessities or useful resource nationalization usually; distant operations and the supply of enough infrastructure; fluctuations in worth and availability of vitality and different inputs obligatory for mining operations; shortages or price will increase in obligatory tools, provides and labour; regulatory, political and nation dangers, together with native instability or acts of terrorism and the results thereof; the reliance upon contractors, third events and three way partnership companions; the dearth of sole decision-making authority associated to Filminera Sources Company, which owns the Masbate Challenge; challenges to title or floor rights; the dependence on key personnel and the flexibility to draw and retain expert personnel; the danger of an uninsurable or uninsured loss; opposed local weather and climate circumstances; litigation threat; competitors with different mining corporations; neighborhood assist for B2Gold’s operations, together with dangers associated to strikes and the halting of such operations infrequently; conflicts with small scale miners; failures of data techniques or data safety threats; the flexibility to take care of enough inner controls over monetary reporting as required by legislation, together with Part 404 of the Sarbanes-Oxley Act; compliance with anti-corruption legal guidelines, and sanctions or different related measures; social media and B2Gold’s fame; dangers affecting Calibre having an impression on the worth of the Firm’s funding in Calibre, and potential dilution of our fairness curiosity in Calibre; in addition to different components recognized and as described in additional element underneath the heading “Threat Components” in B2Gold’s most up-to-date Annual Info Type, B2Gold’s present Type 40-F Annual Report and B2Gold’s different filings with Canadian securities regulators and the U.S. Securities and Alternate Fee (the “SEC”), which can be seen at www.sedar.com and www.sec.gov, respectively (the “Web sites”). The checklist shouldn’t be exhaustive of the components which will have an effect on B2Gold’s forward-looking statements.

B2Gold’s forward-looking statements are primarily based on the relevant assumptions and components administration considers affordable as of the date hereof, primarily based on the data obtainable to administration at such time. These assumptions and components embrace, however are usually not restricted to, assumptions and components associated to B2Gold’s capability to hold on present and future operations, together with: growth and exploration actions; the timing, extent, period and financial viability of such operations, together with any mineral assets or reserves recognized thereby; the accuracy and reliability of estimates, projections, forecasts, research and assessments; B2Gold’s capability to satisfy or obtain estimates, projections and forecasts; the supply and value of inputs; the value and marketplace for outputs, together with gold; international trade charges; taxation ranges; the well timed receipt of obligatory approvals or permits; the flexibility to satisfy present and future obligations; the flexibility to acquire well timed financing on affordable phrases when required; the present and future social, financial and political circumstances; and different assumptions and components usually related to the mining trade.

B2Gold’s forward-looking statements are primarily based on the opinions and estimates of administration and mirror their present expectations relating to future occasions and working efficiency and converse solely as of the date hereof. B2Gold doesn’t assume any obligation to replace forward-looking statements if circumstances or administration’s beliefs, expectations or opinions ought to change aside from as required by relevant legislation. There might be no assurance that forward-looking statements will show to be correct, and precise outcomes, efficiency or achievements might differ materially from these expressed in, or implied by, these forward-looking statements. Accordingly, no assurance might be on condition that any occasions anticipated by the forward-looking statements will transpire or happen, or if any of them do, what advantages or liabilities B2Gold will derive therefrom. For the explanations set forth above, undue reliance shouldn’t be positioned on forward-looking statements.

Cautionary Assertion Concerning Mineral Reserve and Useful resource Estimates

The disclosure on this information launch was ready in accordance with Canadian Nationwide Instrument 43-101, which differs considerably from the necessities of the USA Securities and Alternate Fee (“SEC”), and useful resource and reserve data contained or referenced on this information launch might not be corresponding to related data disclosed by public corporations topic to the technical disclosure necessities of the SEC. Historic outcomes or feasibility fashions introduced herein are usually not ensures or expectations of future efficiency.

Photographs accompanying this announcement can be found at

https://www.globenewswire.com/NewsRoom/AttachmentNg/a589d4e7-7dec-4ee1-a1df-20eb7a00052e

https://www.globenewswire.com/NewsRoom/AttachmentNg/33f00ca3-3ee1-4c8c-8d49-cc9beb3ff610

For extra data on B2Gold please go to the Firm web site at www.b2gold.com or contact: Michael McDonald VP, Investor Relations & Company Growth +1 604-681-8371 investor@b2gold.com Cherry DeGeer Director, Company Communications +1 604-681-8371 investor@b2gold.com